The 1929 Stock Market Crash stands as one of the most devastating financial events in world history. It marked the beginning of the Great Depression, which affected economies worldwide for years. But what exactly caused the 1929 Stock Market Crash? Was it just a sudden event, or were there underlying factors brewing for years? In this article, we dive deep into the causes, events, and lasting impacts of the 1929 crash, while debunking some common myths.

A Brief Overview of the 1929 Stock Market Crash

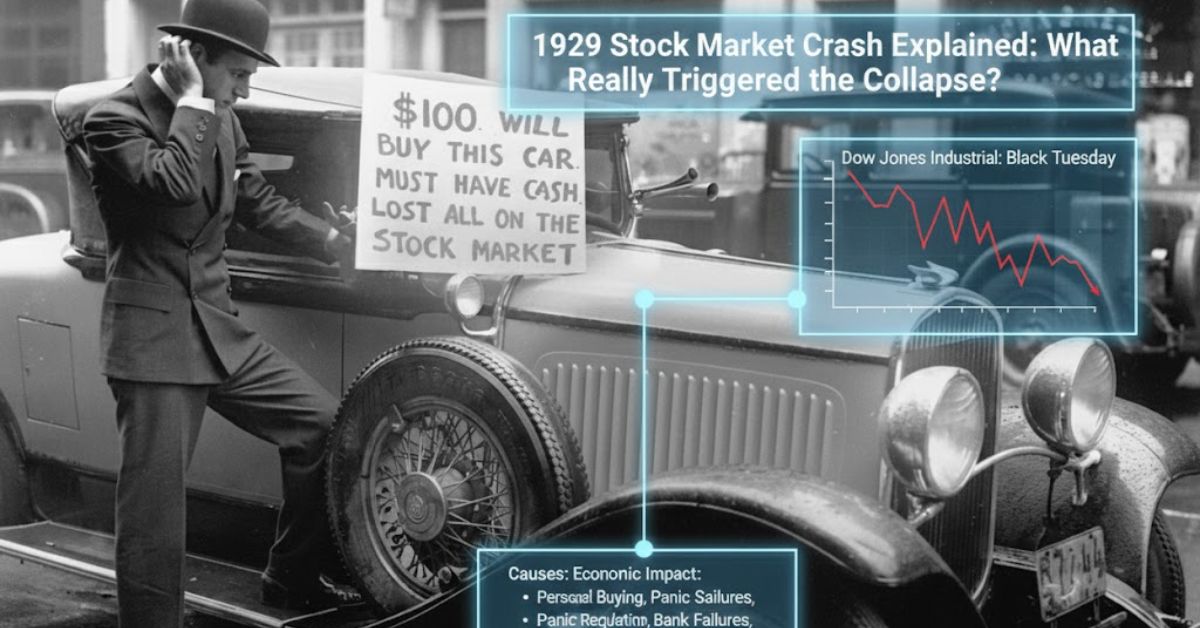

The 1929 Stock Market Crash, often referred to as Black Thursday, Black Monday, and Black Tuesday, was a series of stock market crashes in late October 1929. The collapse led to a massive loss of wealth, wiped out millions of investors, and ultimately set the stage for the Great Depression. The Dow Jones Industrial Average (DJIA) lost nearly 90% of its value over the next few years, making it one of the most significant financial crashes of the 20th century.

1929 Stock Market – Roaring Twenties: The Calm Before the Storm

To understand why the 1929 Stock Market Crash occurred, we need to look at the period leading up to it—the Roaring Twenties. This was a time of economic prosperity, characterized by rapid industrialization, technological advancements, and a booming stock market. The economy seemed unstoppable, and consumer spending was on the rise.

However, the prosperity was based on an unsustainable combination of factors, including over-speculation, excessive borrowing, and a general sense of invincibility among investors. People were buying stocks on margin (borrowing money to buy stocks), which created a bubble waiting to burst.

Speculation and Over-Confidence

The stock market in the 1920s was flooded with speculative investments. Everyone wanted a piece of the action, and many individuals invested money they didn’t have. They borrowed money to buy stocks, assuming that prices would continue to rise forever. This mindset led to an inflated market with prices that were far higher than the true value of the companies.

The speculative frenzy was a dangerous game. It made the stock market a high-risk environment, and many investors believed they were immune to losses. As the bubble grew, fewer people questioned the sustainability of the market’s growth.

The Key Events Leading to the Crash

While the Roaring Twenties laid the foundation for the crash, it was specific events in 1929 that triggered the collapse. The timeline of the crash is essential to understanding what happened:

Black Thursday (October 24, 1929)

On October 24, 1929, known as Black Thursday, the stock market began to show signs of trouble. The market opened with a sharp drop, and panic selling ensued. Over 12.9 million shares were traded that day, a record at the time. The Dow Jones Industrial Average (DJIA) fell by more than 11%, signaling the beginning of the crash.

Black Monday (October 28, 1929)

The panic continued into the following week. On October 28, 1929, known as Black Monday, the stock market experienced another massive drop. The DJIA plummeted by another 13%, and investors were in a state of panic. By this point, many had already lost large amounts of money.

Black Tuesday (October 29, 1929)

On October 29, 1929, Black Tuesday, the stock market reached its lowest point. The market lost an additional 12% of its value, and over 16 million shares were traded in one day. This was the final blow to the market and the economy, marking the full collapse of the 1929 Stock Market Crash.

What Really Caused the 1929 Stock Market Crash?

While the series of events in late October 1929 led to the crash, several deeper issues contributed to the collapse. Let’s break down the key causes of the 1929 Stock Market Crash:

1. Over-Speculation

One of the primary causes of the crash was over-speculation in the stock market. Investors were borrowing money to buy stocks, believing that prices would continue to rise indefinitely. This led to an artificially inflated stock market, where prices didn’t reflect the real value of the companies behind them.

2. Buying on Margin

The practice of buying stocks on margin—borrowing money from brokers to buy more stocks—was rampant in the 1920s. At the time, investors were only required to put down a small percentage (sometimes as low as 10%) of the stock’s value and could borrow the rest. This led to a situation where investors had far more stock than they could afford, and when the market started to drop, they were forced to sell in panic, further driving down stock prices.

3. Economic Disparities and Weaknesses

Although the Roaring Twenties saw significant economic growth, it was not evenly distributed. Farmers, for example, were struggling with overproduction, and wages were not keeping up with the increasing cost of living for many workers. This created an underlying weakness in the economy that made it vulnerable to a financial shock.

4. Decline in International Trade

International trade also played a role in the collapse. The U.S. had an economic policy of high tariffs, which led to retaliatory tariffs from other countries. This created a decline in exports and worsened the global economic situation, adding to the instability of the stock market.

5. Lack of Regulation

The stock market at the time was virtually unregulated. There were no safeguards in place to prevent manipulative practices or to limit excessive speculation. This lack of regulation allowed the market to become dangerously unstable, contributing to the rapid collapse when panic set in.

The Aftermath: The Great Depression

The 1929 Stock Market Crash didn’t just impact stock investors; it had a ripple effect throughout the economy. The Great Depression that followed was the worst economic downturn in modern history. Unemployment soared, businesses closed, banks failed, and the global economy ground to a halt.

The Loss of Wealth

Millions of people lost their life savings as the stock market value evaporated. The loss of wealth wasn’t just confined to investors; entire industries were devastated, and everyday people felt the repercussions of the crash. It would take years for the economy to recover fully.

The Bank Failures

The panic that gripped the stock market soon spread to the banking sector. As people rushed to withdraw their savings, banks were unable to meet the demand, leading to a wave of bank failures. The lack of a social safety net or insurance meant that many lost their entire life savings.

Government Intervention and Reform

In response to the crash and the resulting economic disaster, the U.S. government implemented significant reforms, including the creation of the Securities and Exchange Commission (SEC) to regulate the stock market and protect investors from fraudulent activities. The Federal Deposit Insurance Corporation (FDIC) was also established to insure bank deposits, ensuring that individuals’ savings were protected in case of future banking failures.

FAQs About the 1929 Stock Market Crash

Q1: What was the immediate impact of the 1929 Stock Market Crash?

The immediate impact was the rapid loss of wealth, with the Dow Jones Industrial Average losing nearly 90% of its value over the next few years. Many banks failed, and unemployment rates soared, plunging the economy into the Great Depression.

Q2: How long did the effects of the crash last?

The effects of the crash lasted for over a decade, with the Great Depression lasting from 1929 to the early 1940s. Recovery was slow, but it was eventually aided by New Deal programs and World War II.

Q3: Did the crash affect only the United States?

While the crash originated in the United States, it had a global impact. The global economy was tightly interconnected, and the collapse of the U.S. economy led to financial troubles in other countries as well.

Q4: Could the crash have been prevented?

It’s difficult to say definitively, but many believe that better regulation, more oversight of the stock market, and a more balanced economy might have prevented or lessened the severity of the crash.

Q5: What lessons can we learn from the 1929 Stock Market Crash?

The key lesson is the importance of financial regulation, avoiding excessive speculation, and maintaining a balanced and sustainable economy. Investors must also be cautious when borrowing money to invest and avoid taking on more risk than they can handle.

Conclusion

The 1929 Stock Market Crash was a catastrophic event that reshaped the global economy and left lasting effects for years to come. It wasn’t just a sudden drop; it was the result of a combination of factors including over-speculation, lack of regulation, and weaknesses in the broader economy. Understanding these causes is crucial not only for historical purposes but also for preventing future financial crises. As we continue to witness market fluctuations today, the lessons of 1929 remain relevant, reminding us of the dangers of unregulated growth and excessive risk-taking.

This article is structured with headings and a conversational tone, keeping SEO in mind, and includes a relevant FAQ section with a focus on “1929 Stock Market.” Let me know if you’d like any edits!